In the aftermath of big force and budget cuts—and the promise of more to come—Washington has begun to hear major questions about the fate of the defense industrial base under the new Administration.

Will the Department of Defense in future years have access to several viable competitors for weapon systems? Is the Pentagon doing enough to develop technologies that will be critical to advanced weapons of the next decades? Can the United States count on its industry to surge production, as it has in many past emergencies

|

F-22s on the production line |

The proximate source of concern is Defense Secretary Robert M. Gates’ declarations of April 6, dubbed by one lawmaker as “Bloody Monday.” Gates released a stunning budget proposal for next year that slashes through the heart of many of the military’s highest-profile programs—from the Air Force’s F-22 fighter and next generation bomber to the Navy’s cruiser program and the Army’s prized Future Combat Systems.

“During World War II, we called ourselves the ‘Arsenal of Democracy,’” said a report from the Washington-based Aerospace Industries Association. “If we don’t act quickly and prudently, a future Administration could find the arsenal empty and quiet.”

Production of Lockheed Martin’s F-22 fighter, Gates said, would end with 187 models, some 60 short of what had been USAF’s “medium-risk” force. The move has ignited a storm of protest.

“I strongly oppose [Gates’] decision to halt production of the F-22 Raptor,” said Sen. Joseph I. Lieberman (I-Conn.), whose state is home to engine-maker Pratt & Whitney. “If we stop the F-22 program now, our industrial base will suffer a major blow before the F-35 … reaches full-rate production.” Pratt & Whitney manufactures the engines for both fighters.

Former Air Force Secretary Michael W. Wynne was even more forceful. “Terminations in the air, space, helicopter, and bomber domain will essentially gut American aerospace engineering,” Wynne warned in an April op-ed.

Even the Pentagon, in its industrial capabilities report to Congress released the same week as Gates’ announcement, sounded a cautious tone.

“There are currently no plans … for a sixth generation military-combat aircraft—a follow-on to the F-22A,” the report noted. “While Lockheed Martin and Sikorsky futures look bright, … other primes and subtier suppliers not participating in the F-35 or UH-60M programs may be forced to exit the business, consolidate, or find non-DOD work.”

The Pentagon study confirmed that the “military aircraft design and development workload is at a historic low.”

Jeremiah Gertler, assistant vice president for defense policy at the Aerospace Industries Association, said that the industry is anxiously awaiting the outcome of this year’s Quadrennial Defense Review, which will provide the first detailed look at the new Administration’s long-term defense plans.

“It’s hard to be very confident that this Administration’s going to manage the defense industrial base as a strategic asset,” said Barry D. Watts, a senior fellow at the Center for Strategic and Budgetary Assessments who served as the head of the Pentagon’s Office of Program Analysis and Evaluation in 2001 and 2002.

Concerns reach across the Air Force’s portfolio and beyond. Also on the chopping block are several programs facing developmental or political problems, including the CSAR-X combat search and rescue helicopter for the Air Force, the YAL-1 Airborne Laser, the Transformational Satellite Communications (TSAT) System, and the Navy’s VH-71 Presidential helicopter.

USAF was told to cease further production of the advanced C-17 airlifter. The Pentagon doesn’t want any more of the Boeing-built cargo aircraft, the Defense Secretary said.

These decisions affect each of the country’s major defense firms and countless suppliers sprinkled in nearly every state across the country.

A C-17A lines up to take on fuel.

From an aerospace perspective, the only major bright spots in Gates’ proposal were the F-35 Lightning II, purchases of which might be speeded up, and Predator and Reaper unmanned aerial vehicles, part of a $2 billion increase destined for intelligence-surveillance-reconnaissance capabilities.

AIA’s Gertler said the sweeping Quadrennial Defense Review could usher in even larger changes than seen in the 2010 budget. He emphasized that, at present, the defense industry is healthy and strong, but also hinted at looming problems for small suppliers that do not have a diversified portfolio and rely on one or two programs for the bulk of their profits.

Industrial Base Health

Those smaller firms, in particular, need more predictability and stability for long-term planning, he said.

Rep. Todd Akin (R-Mo.), a member of the House Armed Services Committee, expressed growing concern about the health of the defense industrial base. Akin is worried about small machine shops and other suppliers going out of business. Those operations, he said, aren’t likely to be the beneficiary of a sizeable government bailout, yet they play a crucial role in large programs.

Akin, whose district is adjacent to Boeing’s defense headquarters, also said efforts to significantly trim back defense spending—and delay new starts to programs—will push some smaller players out of key defense business areas.

If you make deep cuts to the military budget, “you get to the point where you don’t even know if you can keep one solid supplier going,” he said.

AIA, whose members include both the small players and defense giants such as Boeing and Lockheed Martin, warned in a report last summer that planners must “guard against the shortsightedness of curtailing the current modernization drive prematurely.”

In the report, titled “US Defense Modernization: Today’s Choices for Tomorrow’s Readiness,” AIA signaled that growth in the Pentagon’s operations and personnel accounts could eventually put the squeeze on procurement and add to the uncertainty surrounding acquisition programs.

“Continuing this trend beyond current projections will make it even more difficult for defense planners to adequately resource the investment spending upon which our military superiority and technological edge depends,” the report stated. “The next Administration should address this serious, future resource challenge in developing long-range defense plans and in budget guidance to the next Quadrennial Defense Review.”

Programs such as the next generation bomber, which was created out of the last quadrennial review, are crucial to maintaining the industrial base, AIA argued in its report.

There are only a few design teams and facilities capable of creating and building the next bomber and, once lost, those domestic capabilities would be difficult to regain. There is a strategic danger if cuts today eviscerate the nation’s long-term ability to design and manufacture advanced military aircraft. Gen. Norton A. Schwartz, Air Force Chief of Staff, acknowledged as much when commenting on Gates’ decision to send the 2018 bomber back to the drawing board.

Unlike the annual budget, the QDR should take the health of the industrial base into account when deciding on a course of action for a next generation bomber. “Keeping design teams together is a matter that the department needs to consider,” Schwartz said in mid-April.

Industrial base concerns extend beyond bombers. The planned moves will idle the F-22 and C-17 lines. General Atomics Aeronautical Systems has a near-monopoly on combat UAVs through the Predator and Reaper, and the massive F-35 program won’t be ready for combat for at least three years.

|

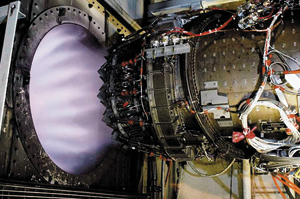

The GE-Rolls Royce variant of the F-35’s engine during tests. |

Realistic Competitions

The Pentagon’s own industrial base report notes that “over the next five to 10 years, most current military aircraft production programs will end, precipitating the need for a new round of consolidation in order to reduce infrastructure costs.” The report also mentioned, however, the need to maintain realistic competitions for combat aircraft production.

But even as the country faces ever-escalating unemployment rates, senior defense officials have made one point abundantly clear: Jobs are not, and will not be, a consideration in procurement and budget decisions.

The Pentagon has argued repeatedly that acquisition officials must select only the products that provide the best value to the taxpayer. In announcing his cuts, Gates said he is “concerned for the possibility that these decisions will have an impact on individual companies and workers around the country.” But Gates also stressed that his decisions were apolitical and that he did not directly weigh industrial base concerns in crafting his budget proposal.

Gates suggested that increases to programs such as the F-35, which will employ 82,000 people in 2011, could mitigate the job losses and the effect on industry. He also noted, however, that direct F-22 employment would decline from 24,000 aerospace workers today to 13,000 in 2011, before phasing out completely. Lockheed Martin has said the Raptor program indirectly supports a total of 95,000 workers.

As the Defense Department moves forward its procurement neck down, many industry observers believe the Pentagon should tread carefully. After all, DOD cannot afford to lose the remaining major players if it hopes to have a choice of competitors on future major weapons systems.

Indeed, prime contracts awarded to midsize firms shrunk from 50 percent to 30 percent from 1995 to 2004, while service contracts to those second-tier companies fell from 44 percent in 1995 to 33 percent in 2006, according to a July 2008 Defense Science Board report that examined the defense industrial base. Meanwhile, the five largest prime contractors dominate the landscape, with discretion over 40 percent of the acquisition budget.

“While competition still occurs between a few firms in each sector, the government buyer can no longer benefit from a highly competitive defense market,” the DSB report stated. “The government now has to play a considerable role in maintaining minimal competition.”

Watts, meanwhile, argues that the effect that high-stakes decisions on weapons systems have on the economy should at least be weighed by the Pentagon. “On the one hand, I sympathize with Secretary Gates that you don’t want to continue pumping money into dubious programs just because of jobs in 45 states,” he said. “But on the other hand, largely ignoring the cumulative effect of successive program decisions on the industrial base—especially if you want to have more than one competitor in major mission areas—appears to be shortsighted in much the same way that subprime mortgages and collateralized debt obligations have proven to be.”

In a study last year titled “The US Defense Industrial Base: Past, Present, and Future,” Watts wrote that the industry is not facing an imminent crisis, but suggested that the government take a more strategic approach to maintaining its industrial base.

“The extent to which the American defense industry will continue to be an enduring source of strategic advantage depends on whether the federal government as a whole, not just DOD, embraces a more consistent, thoughtful, longer-term, and active strategy for influencing the structure and capabilities of the American defense-industrial base,” he wrote.

In his report, Watts recommended that the Pentagon consider making a contract’s potential impact on the industrial base a formal selection criterion.

There have been some efforts on Capitol Hill to make industrial base considerations a part of acquisition decision-making, most recently after the Air Force selected a team led by Northrop Grumman and EADS, the European parent company of Airbus, to build the service’s next fleet of aerial refueling tankers. The contract award was later overturned after the Government Accountability Office upheld a protest filed by Boeing, the losing bidder.

A senior Senate Democrat recently told reporters that his concerns about the defense industry are part of his broader worries about the country’s manufacturing base, which lost three million jobs during the Bush Administration.

“We have hurt our manufacturing base tremendously in this country by ignoring its importance to the economy, as well as to our national security,” said Senate Armed Services Chairman Sen. Carl Levin (D-Mich.), whose home state has been devastated by the failing domestic automotive industry.

|

Pratt & Whitney runs tests on its F135 version. |

Major Struggles

Levin said he remains concerned about the industrial base. But he said that he could not push to make jobs a key issue in procurement decisions as he works with President Obama and others on efforts to reform the Pentagon’s weapons-buying processes to bring down costs.

“If I could find some intellectual way to do it, believe me I would,” Levin said. “I don’t know how you factor it in.”

House Armed Services ranking member Rep. John M. McHugh (R-N.Y.) said in a March interview that the Defense Department needs to come up with an effective way of ensuring the industry’s health in the future. (McHugh has since been nominated to be Secretary of the Army.)

The result, he said, would be a bidding system that protects taxpayers and, at the same time, protects industrial capacity. But McHugh said no one has yet developed a sound policy to do so.

“At the present time, we’re lacking any coherent policy to ensure we have the sufficient base … essential to a successful military,” he acknowledged.

Boeing, for instance, is struggling to stay in the tactical aircraft business. It is a major subcontractor on the F-22 program, but that assembly line now appears poised for a shutdown. Boeing lost the F-35 contract to rival Lockheed Martin, which now has the lock on the fifth generation fighter business.

If Boeing were to lose another contract in this arena, the country could end up with just one prime contractor capable of designing and building fighters.

Boeing is marketing a new version of the F-15—the Silent Eagle—internationally, in the hopes of keeping that program’s lines alive. Potential customers include Israel, Japan, Saudi Arabia, Singapore, and South Korea.

|

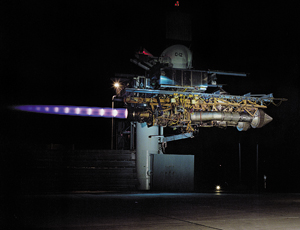

The Airborne Laser soars over Mojave, Calif. The ABL system got chopped from the budget. DOD notes that another round of industrial consolidations may be necessary. |

Domestically, Boeing has pinned its hopes to the future of the F/A-18E/F Super Hornet fighter for the Navy, seeking a multiyear contract to keep the F/A-18 supplier base in business. Gates’ spending proposal includes money for 31 Super Hornets next year—better than nothing, but not the multiyear commitment Boeing and its suppliers had hoped for.

An active Raptor line could provide valuable strategic insurance in the event that some sort of major delay or problem arises in the F-35 program, but the Silent Eagle or Super Hornet could also ensure that the US has an alternative if new fighters are suddenly needed—with the side benefit of preserving two producers.