United Technologies/Raytheon merger presentation slide.

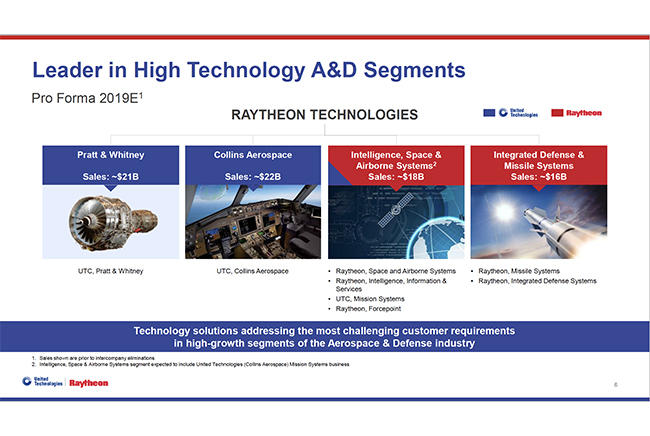

The “merger of equals” between Raytheon and United Technologies into the new Raytheon Technologies would vault the No. 3- and No. 8-ranked US defense contractors, respectively, into a joint No. 2 position, just behind Lockheed Martin, and is touted by the two companies’ CEOs as a “platform agnostic” concern not dependent on any particular program.

The stock-swap merger, announced over the weekend, would create a $100 billion enterprise encompassing Raytheon’s varied missile, sensor, ISR, and command and control programs with UTC’s engine and aerospace components business with “very little overlap,” Gregory Hayes, UTC CEO, said in a June 10 conference call. Purely in terms of defense contracts, Boeing would slip to the No. 3 position among the top 10 contractors. In world combined aerospace and defense (civil and military) revenues, the new company would be third—after Boeing and Airbus, respectively.

The companies are aiming for the merger to be complete by the first quarter of 2020, Hayes reported. It requires Federal Trade Commission review and approval, as well as the Defense Department’s acquiescence. If approved, the new company will trade on the New York Stock Exchange under the symbol RTX.

The move comes just a year after UTC acquired what is now Collins Aerospace, and after announcing a move to spin off its Otis and Carrier divisions, which make elevators and air conditioning systems, respectively.

Hayes told investors and business reporters on the conference call there would be about $1 billion in cost savings from aligning the companies “by year four,” and that half of this would be “shared with government customers,” suggesting this is a reason the Defense Department “is really going to like this deal.”

In a press statement, Pentagon spokesman Lt. Col. Michael Andrews said Ellen Lord, undersecretary of defense for acquisition and sustainment, is “engaging with industry leadership to understand the implications and governance as a result of this acquisition. We look forward to working with Raytheon Technologies Corp, to provide the best capabilities our warfighters deserve, as the greatest value to the taxpayer.” He added that Lord will keep Acting Defense Secretary Patrick Shanahan and comptroller David Norquist “updated.”

President Donald Trump, appearing on the CNBC financial program “Squawk Box,” said he is concerned the merger will “take away more competition.” While the merger will create “one big, fat beautiful company,” Trump said the “United States has to buy many things. Does [the merger] make it less competitive? Because it’s … already not competitive,” he said.

The most recent big defense industry consolidation before the Collins deal also involved UTC, when it sold its Sikorsky helicopter unit to Lockheed Martin in 2015.

Hayes said despite speculation, UTC will not be leaving Connecticut, and Raytheon will continue to be a presence in Massachusetts.

Hayes and Thomas Kennedy, Raytheon CEO, said there will be synergies for new products between the companies; marrying, for example, Raytheon’s laser and directed energy systems with Pratt’s power-generation and thermal management systems. Another synergy mentioned included Raytheon’s hypersonic missile research with UTC’s knowledge of high-temperature materials, thermal management, and advanced propulsion. Because the two companies are generating about $75 billion to $80 billion a year in cash, there will be plenty to invest in research and development and there will be “many opportunities for new franchises,” Hayes said, adding that the new organization will have more than 60,000 engineers.

In addition, the two companies’ significant commercial aerospace business—nearly half of revenues—will make it “more resilient across business cycles,” Hayes also said.

Raytheon’s largest projects include Patriot air defense missile systems; SM-3 ballistic missile interceptor missiles; AIM-120 and AIM-9X dogfight missiles; AESA radars for fighter aircraft; HARM, JSOW, and Maverick air-to-ground missiles; Paveway and StormBreaker (formerly Small Diameter Bomb II) guided bombs; the Iron Dome air defense system for Israel; the TOW and Javelin ground-forces missiles; various search and tracking radars; and several hypersonics research projects, which are largely classified, as well as space systems and intelligence, surveillance, and reconnaissance systems that can perform “in contested environments.” Raytheon also makes electronic warfare equipment and countermeasures for aircraft; the AN/ALE-60 towed decoy system and the Miniature Air-Launched Decoy (MALD) and MALD-J jammer variant. In addition, Raytheon makes various ship-based missiles and torpedoes, and the Phalanx close-in air defense gun system, and it has a growing business in cyber protection.

UTC’s Pratt & Whitney division builds the F135 engine for the F-35 Joint Strike Fighter; the F119 turbofan for the F-22 fighter; the F100 and its variants for the F-15 and F-16; the F117 engine that powers the C-17 airlifter, and a number of powerplants for civil airliners, business jets, and helicopters. Collins Aerospace provides military and civilian aerostructures; aerospace avionics; aircraft sensors and fire protection sensors; airliner and bizjet interiors; landing gear systems, such as actuators and mechanicals; propellers, flight controls, hoist and winch systems for helicopters; navigation and electronic warfare equipment; ejection seats; space suits, precision optics; simulation and training gear; unmanned and strategic mission systems; engine controls and air traffic control systems.