Air Force Gets Bigger Slice of Budget

By Greg Hadley and John Tirpak

The Air Force would a get a bigger budget than the Army in fiscal 2025, a marked shift as the Pentagon invests to counter China in the Indo-Pacific region.

President Joe Biden’s fiscal 2025 budget request released March 11 seeks $188.1 billion for the Air Force, $2.3 billion more than the $185.8 billion it seeks for the Army. The White House is seeking $203.9 billion for the Navy, the most among the military services.

The Air Force request marks 1.6 percent growth, or $3 billion over the fiscal 2024 budget request, while the Space Force request marks a decline of $600 million, or 2 percent. All figures are in constant dollars, not adjusted for inflation, indicating both services would actually see a decline in buying power.

“We are not quite keeping up with inflation,” Acting Air Force Undersecretary Krysten Jones told reporters.

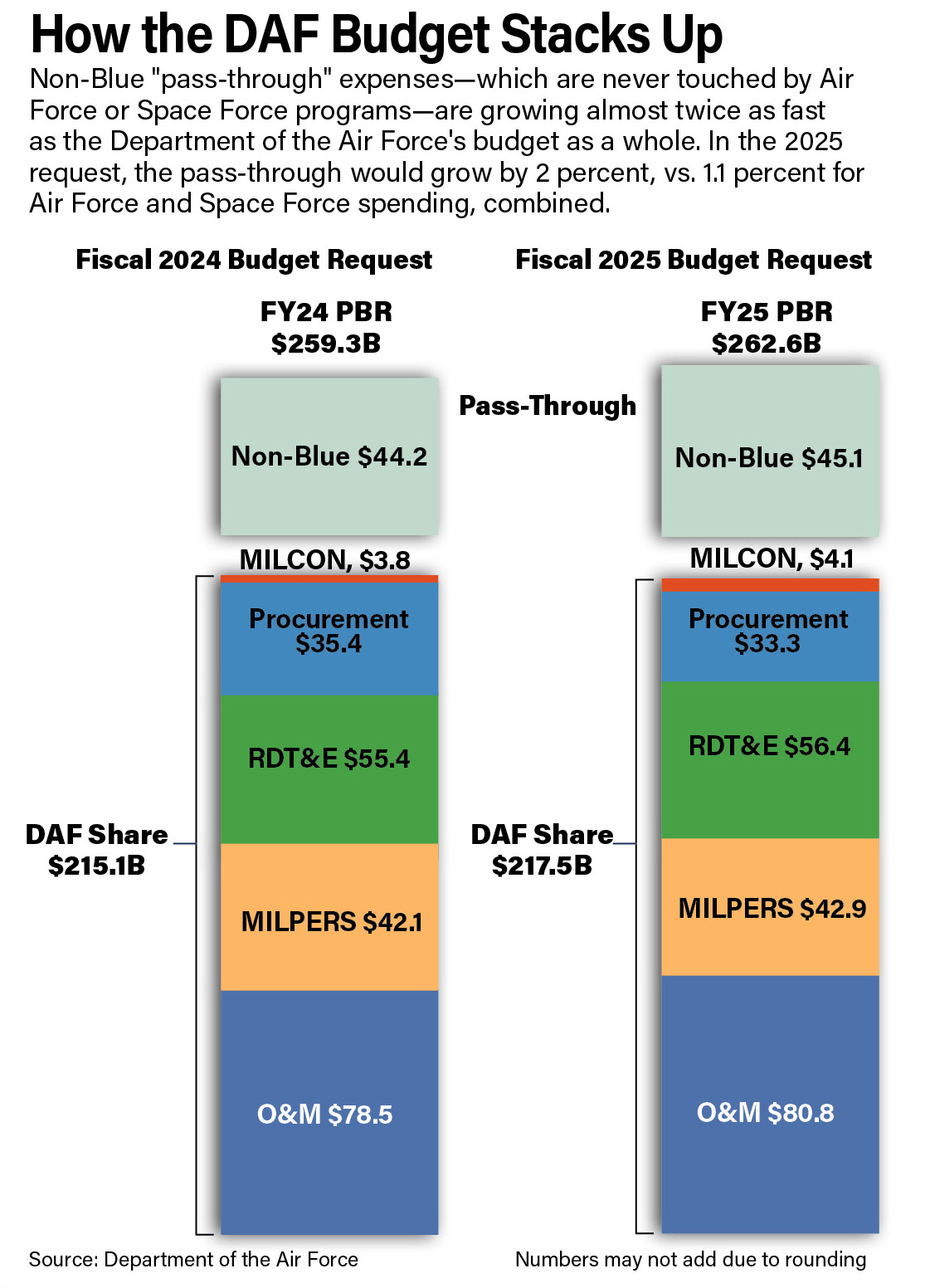

The overall top line for the Department of the Air Force would be $262.6 billion, the most among the military departments. But that figure includes $45.1 billion that the department will never see; this so-called “pass-through” funds classified programs primarily in the Intelligence Community. The pass-through dwarfs the total $29.4 billion sought to fund the entire Space Force in fiscal 2025.

“I consider this to be an acceptable budget, I can defend it,” said Air Force Secretary Frank Kendall. “It’s moving forward on the things that we prioritize. I’d like to be able to move faster, but you know, we do have constraints.”

But a macro view does show some progress. Removing pass-through funds from the equation, the nation spent less on the Air Force than either the Navy or the Army for the past 32 years straight, according to the Mitchell Institute for Aerospace Studies. But, if approved, the Air Force would move ahead of the Army, while still remaining behind the Navy in the race for funds.

The Fiscal Responsibility Act, passed by Congress last summer, imposed some $2 billion in reductions on the Department of the Air Force cuts; budgets were already largely complete. Kendall said that forced “us to make some hard choices to fit within those boundaries.”

Harder choices will come in the next few budgets, Kendall said. “We’ve got some tough choices … when we get to [FY] ’26, which we’re building now,” Kendall said. Among the challenges in that budget will be accommodating a nearly $40 billion overrun on the Sentinel intercontinental ballistic missile program, although the Air Force is looking for economies and that bill doesn’t have to be paid in a single year.

In making choices, Kendall said his priority “is to get to a next generation of capabilities” to offset China’s military advances. As a result, the budget seeks to “protect” Kendall’s seven Operational Imperatives—the key modernization investments he first outlined in 2022. Consequently, there was “a trade-off” between what he called “the mid-term force”—things that are already developed and which the Air Force is buying—and research and development of “the longer-term force.”

“What we’re doing, essentially … is buying options for people to procure things in the future. So all that research and development essentially doesn’t give you anything immediately, it gives you an option to then exercise for production later,” he said.

The Air Force and Space Force are racing to “re-optimize” for a great power competition—that is, to better prepare to stave off and fight, if necessary, against a peer threat like China. Air and space power will be essential in such a conflict, whether it plays out in the air, in space, on the seas, or on land.

The Army’s slice of the budget has been in a slow decline for several years. As recently as the 2022 budget request, the Pentagon sought $172.9 billion for the Army compared to $156.3 billion for the Air Force; the gap has only narrowed since then.

Yet the Air Force faces a mounting numbers crunch in the years ahead. Air Force Secretary Frank Kendall and Chief of Staff Gen. David W. Allvin both made clear in the days leading up to the budget release that the numbers aren’t what they’d like. But both also indicated the squeeze on the service’s future will only grow as it seeks to modernize in the years ahead.

Modernization plans include the Sentinel intercontinental ballistic missile, perhaps the single biggest modernization program in military history comprising the entire ground leg of the nuclear triad; the stealthy new B-21 bomber; the T-7A trainer; continued purchases of the KC-46 tanker to enable long-range strike operations in the Pacific; uncrewed Collaborative Combat Aircraft (CCA) to complement the manned fighter fleet; ongoing purchases of the F-35A as older F-15s and A-10s are divested; and the coming Next-Generation Air Dominance (NGAD) family of aircraft are all moving into procurement at the same time.

“[Fiscal] ’25, while difficult, is at a level that we can accept,” Kendall said March 7 at the McAleese defense programs conference. “[But] we see very big problems for ’26. We’re looking at a number of things.”

To fund everything the Air Force has in store could add $10 billion or more to the budget at a time when Congress has shown a disinclination toward growing defense spending. Some Air Force advocates have argued that the pass-through makes their case harder, because it effectively inflates the budget by more than 20 percent. But while some lawmakers have tried to legislate the pass-through out of the Air Force budget, others have shot down such plans.

Meanwhile, the pass-through is only getting larger. The fiscal 2025 request includes $45.1 billion in pass-through funding, up 2 percent over last year’s request. Indeed, pass-through growth is outpacing the Air Force (up 1.6 percent), not to mention the Space Force, which saw its budget request decline by 2 percent.

Kendall said he could accept that this year because some funding in the pass-through does help answer Space Force requirements.

“We’re working very closely with the Intelligence Community, particularly with NRO,” he said, referring to the National Reconnaissance Office. “And there are dual-use capabilities that can be fielded in space that are valuable both for intelligence and military applications. And that’s why I’m saying that some of the things that are in the pass-through are beneficial to the Space Force.”

Constraints impose reductions in planned fighter aircraft and continued divestment of older aircraft, both of which will be hard sells in Congress. But unless Congress adds funds to pay for those, the pressure on other programs, both for people and systems, will continue to mount.

As an example of leadership’s thinking, the budget purchases of F-35 and F-15EX fighters, preserves previously planned developmental funding for the Next-Generation Air Dominance fighter and CCA.

Funding of NGAD and CCA development amounts to $3.3 billion in 2025, up $815 million and $165 million, respectively. But for both programs, “life gets a lot harder after ’25,” Kendall said.

Jones said it will cost about $1 billion extra to achieve the same levels of readiness and flying hours in fiscal ’25 as it did in ’24. This drove “difficult decisions” in munitions, for example, where “we are buying, in some cases, slightly fewer munitions for the same price” as in fiscal 2024, she said.

Space Force Faces First-Ever Budget Cut in 2025

By Unshin Lee Harpley

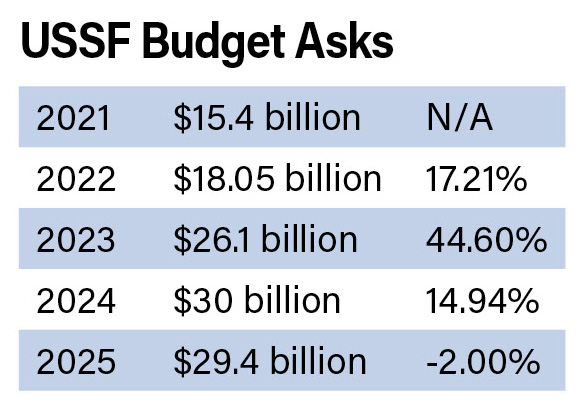

The Space Force budget request declined for the first time in its brief history as the Pentagon unveiled a $29.4 billion request for Space Force funding March 11, a 2 percent drop from last year’s ask, and a reversal after years of dynamic growth.

Air Force Secretary Frank Kendall and other leaders highlighted fewer planned satellite launches as a key reason for the smaller budget. In a briefing with reporters, Kendall pointed out that “payloads have not been ready,” leading to delays in launches and resulting in a smaller number of launches than initially planned for the fiscal year.

“Last year, we had planned 15 total space launches, and that will be 11 in the ’25 budget plan,” he said.

Maj. Gen. Michael A. Greiner, deputy assistant secretary of the Air Force for budget, said the reduction “was not necessarily due to [spending] caps or having to make tough choices, that’s really just how we look through the long-range strategic satellite launch manifest. These are the capabilities in the launches that we need, in order to get the satellites on orbit that we need as well and those that are ready to go.”

Of the 11 launches planned within the National Security Space Launch program, four will be designated for deploying satellites in low-Earth orbit for the Space Development Agency’s constellation. FY25 will mark the first year of NSSL Phase 3 procurement, which is meant to increase competition and open the door to smaller launch providers through a so-called “dual-lane” approach.

Kendall said the spending caps set by the Fiscal Responsibility Act limited what he could do to protect the Space Force’s budget, which is skewed heavily toward research and development.

“We’re not moving as fast there as we would like to, but we didn’t have any place to make any adjustments,” he said.

Accordingly, the Space Force’s research, development, test, and evaluation (RDT&E) and procurement budgets would decline, while operations and management and personnel funds rise modestly.

With the Space Force trimming $500 million from its research and development budget in fiscal 2025, the service is prioritizing the modernization of existing infrastructure to enhance defense and surveillance capabilities.

Missile warning and tracking (MW/MT) funds would reach $4.7 billion, including $2.1 billion for the Next-Generation Overhead Persistent Infrared (Next-Gen OPIR) constellation, and $2.7 billion for the Tracking Layer of the Proliferated Warfighter Space Architecture.

Satellite communications spending would include a little more than $1 billion for the Evolved Strategic Satellite Communication network, for nuclear command, control, and communications, and almost $600 million for Protected Tactical Services (PTS), a jam-resistant system.

The service plans to expand its total workforce by 4 percent to 15,084, combining military and civilian personnel. That will include 9,800 uniformed Guardians, an increase of 400 over last year. That jump will come primarily through interservice transfers. That, combined with raises in pay, Basic Allowance for Housing, and Basic Allowance for Subsistence, contributed to the Military Personnel account inching up $50 million from 2024, to a total of $1.2 billion.

While the overall budget is slightly down, Kendall did note that the “pass-through”—a section of the budget not controlled by the Air Force that goes to classified intelligence programs—does have funds that will enhance the capabilities of the Space Force.

Kendall declined to elaborate, however, on whether the Space Force’s budget reduction was directly related to the pass-through increase.

Shrinking Further, USAF Aims to Divest 250 Aircraft

By Chris Gordon

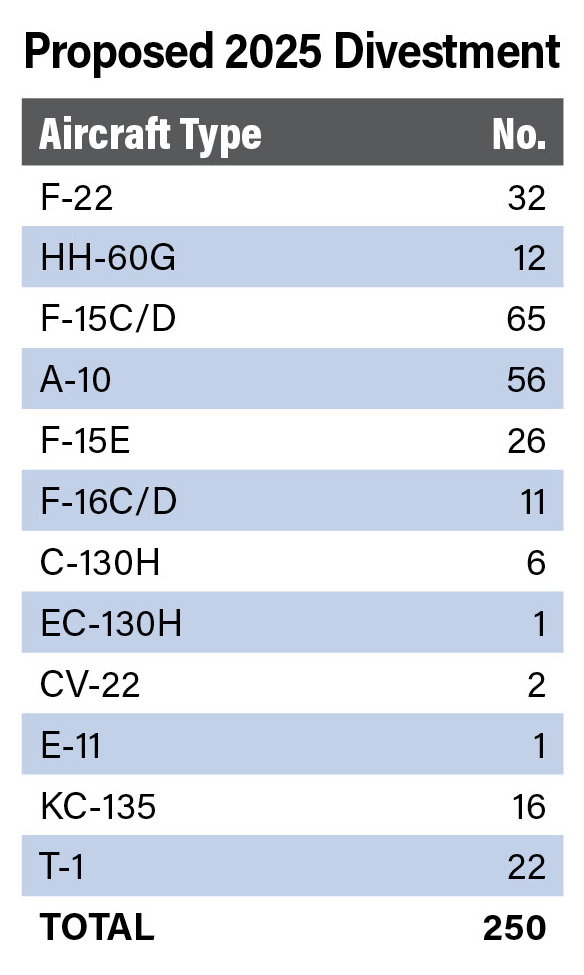

The Air Force plans to shrink its total aircraft inventory next fiscal year, reducing the number of new aircraft it buys while accelerating divestments. The fiscal 2025 budget plan would divest 250 aircraft in a year, reducing the total inventory below 5,000 aircraft for the first time since before World War II.

The aircraft divestment plan will save more than $2 billion annually, said Deputy Assistant Secretary of the Air Force for budget Maj. Gen. Mike A. Greiner.

“We need to start moving the funding into the modernization programs,” Kristyn E. Jones, the acting undersecretary of the Air Force, told reporters March 11.

A-10 and F-15C and E fighters lead the divestments and come as little surprise. Nor is it surprising that the Air Force is trying, for the third year running, to retire its 32 Block 20 F-22s, its oldest fifth-generation fighters.

“Block 20 airframes lack many of the enhanced capabilities of the Block 30/35 jets,” an Air Force spokesperson said of the rationale. “Upgrading them to Block 30/35 is not feasible due to cost and time constraints.”

The aircraft are not combat rated. Used for training, they are among the Air Force’s most expensive jets to operate. But giving them up would increase the reliance on combat-rated aircraft for initial training and reduce combat capacity, a risk Congress has refused to accept in the past two legislative cycles.

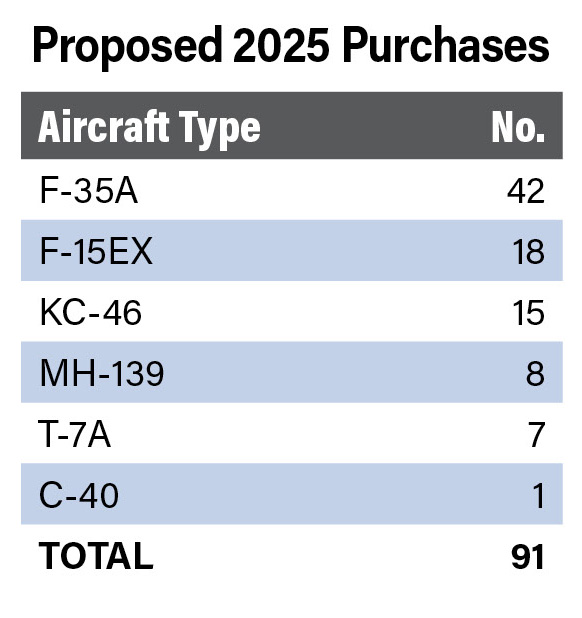

The Air Force’s decision to reduce new fighter acquisitions did come as a surprise to many. The service plans to buy just 42 F-35As, down from last year’s plan to acquire 48 in 2025; it also reduced from 24 to 18 the number of new F-15EXs it would buy, ending the program six short of its previously planned total.

That total of 60 new fighters falls short of the service’s stated long-term goal of acquiring at least 72 new fighters annually. It also falls far short of the 91 F-15 models that it aims to retire. In all, the Air Force plan calls for retiring a total of 190 fighters against 60 new fighters that wouldn’t reach the force for at least two to three years, a major reduction in fighter capacity.

The Air Force is moving toward awarding the first contracts for Collaborative Combat Aircraft (CCA), semi-autonomous aircraft that will accompany the manned fighter fleet. CCA will “rethink our definition” of the USAF fighter fleet, Air Force Chief of Staff Gen. David W. Allvin said on March 7.

“The numbers are going down in the near term,” said Jones. However, she said CCAs could change that calculus in the long term. “We are ramping that program up as much as we can—if we have [fiscal] ’24 appropriation, even faster—to try to get that affordable mass capability to mainly offset those divestments of our old fleet,” she said.

Jones said on March 11 that the decrease in the planned F-35 buy was due to budgetary constraints and delays in the fighter’s planned F-35 Technology Refresh-3 (TR-3), a significant but lagging software upgrade. However, the change does not mean the service is less committed to the F-35 in the long term, she said.

“Given the fiscal constraints this year, as well as the delays in getting the capabilities that we need, we re-phased the program, but we haven’t cut off the total numbers,” Jones said.

Congress has long balked at the prospect of retiring any models of what many see as the world’s best air-superiority fighter and passed legislation prohibiting any such retirements until fiscal 2028. However, the Air Force has held firm in its desire to retire the old Block 20 aircraft—reducing the F-22 fleet from 185 to 153 aircraft—for several years.

“We’ll comply with the law, obviously, but we’re putting those F-22s back on the table in order to fit in the other things we think are higher priority,” Kendall said.

A low-rate initial production of seven T-7A Red Hawk trainers is funded, which will help alleviate the aging T-38 fleet, which has been increasingly hard to maintain to keep training flying hours up, though the T-7 has faced significant delays. The Air Force also plans to add 15 KC-46 Pegasus tankers and to move forward with its long-term plan to bring in the Next Generation Aerial Refueling System (NGAS). “We will work to define and finalize an acquisition strategy this year,” Greiner said.