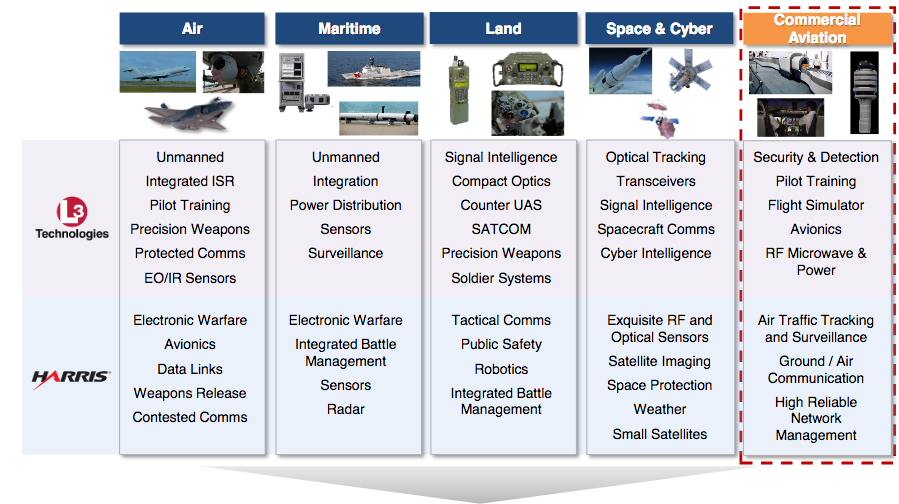

L3 Technologies and Harris Corp. announced plans to merge on Sunday. If approved, L3 Harris Technologies would become the sixth largest US defense contractor. L3 infographic.

Defense contractors Harris Corp. and L3 Technologies announced Sunday they would merge in an all-stock deal that would create a company valued at more than $33 billion, and rank the combined organization at sixth among the top defense contractors.

The merged outfit will be called L3 Harris Technologies, and it will be headquartered in Melbourne, Fla. The Defense Department would have to approve the merger, but the Trump Administration has not signalled a willingness to block similar industry consolidation.

The companies make radios, electronic self-protection gear for aircraft, weapons pylons and actuators, racks, launchers, night vision equipment and other sensors, satellite communications equipment, computers and processors for various systems, and large components for national security satellites, among other products, including civilian law enforcement gear and unmanned underwater vehicles.

With combined military sales of $8.3 billion, the company will rank just behind Lockheed Martin, Boeing, Raytheon, Northrop Grumman, and General Dynamics, respectively, as the sixth largest Pentagon equipment supplier. It will have revenues of some $16 billion and more than 48,000 employees.

The move continues a recent wave of defense mergers and consolidation. Lockheed Martin acquired Sikorsky helicopters two years ago; United Technologies picked up Rockwell Collins last year; and Northrop Grumman purchased Orbital ATK last year. “Second tier” mergers, such as SAIC’s purchase of Engility earlier this year, have also proceeded apace.

L3 itself was created by the consolidation of Lockheed and Martin Marietta, which sold off some of their electronics business units into a single entity after they merged in 1993. The name derived from the names of the investors that bought the units. L3 has acquired other companies on average about every other year since its 1996 founding.