The Space Force plans to award initial contracts as soon as next month for a fleet of small, maneuverable satellites designed to monitor activity in geosynchronous orbit that could be online as soon as 2030, service officials said Jan. 23.

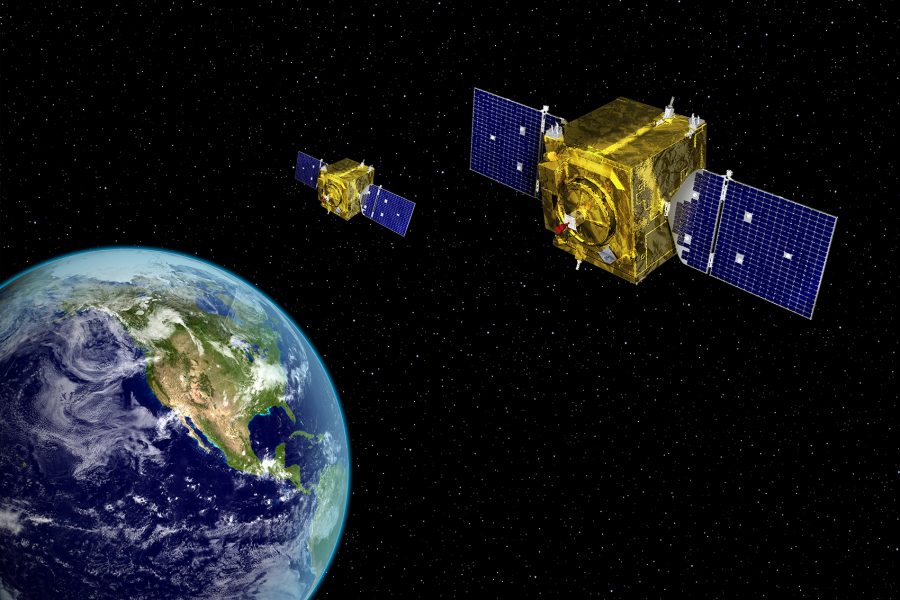

The program, RG-XX, aims to augment and potentially replace the Space Force’s Geosynchronous Space Situational Awareness Program constellation, which observes and tracks objects and behavior in GEO, about 22,000 miles above Earth. The new proliferated constellation would consist of lower-cost satellites with off-the-shelf technology the service could replace or refresh as threats evolve.

The service released a draft solicitation for RG-XX in October, followed by a formal request for proposals Jan. 13. Speaking at the annual Space Systems Command Industry Days event in Los Angeles, Materiel Leader for Space Surveillance and Reconnaissance Lt. Col. Darren Ng said a first round of awards establishing a pool of vendors could come by February or March with initial task orders to follow soon after. That’s a rapid turnaround time for the service that comes as the Pentagon is pushing for faster capability delivery and commercial-first approaches to acquisition.

Following those initial awards—which Ng said will go to multiple companies—the Space Force intends to on-ramp new firms and technology each year. The goal, according to Program Executive Officer for Space Combat Power Col. Bryon McClain, is to update technology and incorporate new requirements on a regular cadence.

“This will allow us, every year, to procure what the service needs based on available funding,” he told reporters in a Jan. 23 briefing. “If there’s new capability out there, we want to pull that in.”

The first round of contracts will inform the Space Force’s longer term plan for RG-XX, McClain said, including how many satellites it will ultimately need and whether it will require them to be refuelable. He noted that while the mission would likely benefit from refueling, the service hasn’t determined whether to invest in the capability and isn’t ready to make it a requirement for industry.

“We intend on using this very first period with our IDIQ to really help us refine the requirement with industry as a partner in this, instead of us just doing an architecture and a design saying, go build this,” McClain said. “We’re trying to lay the groundwork for bigger service decisions that haven’t been made yet.”

Space domain awareness programs like GSSAP and RG-XX give the Space Force another tool for monitoring and responding to threats in space—a growing need for the service as China and Russia demonstrate increasingly aggressive tactics in orbit. U.S. Space Command has called for the service to invest in more maneuverable satellites that can rapidly change orbits, a concept it calls dynamic space operations, but the Space Force hasn’t landed on a strategy to meet that requirement.

In a policy paper issued last November, AFA’s Mitchell Institute argued the Space Force should move quickly to develop the capabilities and infrastructure—like refueling and satellite servicing—to support SPACECOM’s stated need for dynamic space operations. The Space Force has pursued one-off capability demonstrations, some of which are scheduled to launch this year, but hasn’t revealed a long-term plan.

“Hesitance to fully implement dynamic space operations at scale risks ceding valuable time and initiative to adversaries,” the report states. “The Space Force must move decisively to embrace all opportunities of this new operational paradigm.”

Aside from helping inform the Space Force’s refueling strategy and implementing the rapid acquisition tenets Pentagon leaders are pushing, McClain said the RG-XX approach is designed to give industry a stronger demand signal for the types of capabilities it wants them to invest in. McClain said other programs in his portfolio, which is largely classified, have used a similar strategy with some success and he expects to apply it more broadly in the future.

“The IDIQ allows us to narrow down the vendor pool, which allows vendors to focus their internal investments on our mission needs,” he said. “I want competition, I want short buys, but I also want to have a lane, a future, that industry sees that they can leverage for their investments.”