NATIONAL HARBOR, Md.—While Air Force leaders are still refining concepts for the next increment of Collaborative Combat Aircraft, competition to produce compact, low-cost engines for those aircraft is already heating up.

Propulsion firms of all sizes, from industry giants to plucky startups, are working on small engines to power drones and missiles. At the low end, at least half a dozen are working on engines capable of producing 200 to 3,000 pounds of thrust; at the higher end, the Air Force has suggested CCAs might require as much as 3,000-8,000 pounds of thrust. But the activity in smaller engines suggests industry sees compact engines as a compelling market, both for CCAs and for smaller munitions as the Air Force seeks to keep its options open.

Speaking at AFA’s Mitchell Institute for Aerospace Studies last month, GE Aerospace Vice President Steve Russell noted that an early lesson he learned working in the Pentagon is that propulsion systems must start development before the air platform they will eventually go on.

“That was shocking to me at the time. … Everybody we briefed all the way up the chain, it was shocking to them as well,” he added. “And I think what I had in my head prior to that was that these engines are just sitting on the shelf somewhere and when I want a next-gen platform, I go pick one. … [But] the exact opposite is true: You actually have to be investing in the engine technology first, even before you know what your next platform is going to look like.”

No requirements have been set for Increment 2 of CCAs, and the service is not planning to award any preliminary contracts until 2026. But GE and its partner Kratos announced Sept. 23, during AFA’s Air, Space & Cyber Conference, that its new GEK800 engine—which can produce anywhere from 800 to 3,000 pounds of thrust—has begun altitude testing.

RTX’s Pratt & Whitney, which makes the F135 engine used in the F-35 fighter, is working to both adapt its PW300 and PW500 commercial offerings for CCAs, while also developing a new family of engines with 500-1,800 pounds of thrust.

“Looking at Collaborative Combat Aircraft in general, I think everyone knows it’s a spectrum and a range,” said Jill Albertelli, president of Pratt’s military engines division. “Is it something that they want to return and come back? Is it something that is actually deploying effects, or is it something that’s out there and collecting information, creating sensory scrambles? Is it something that’s not going to return? We really have studied this and worked with the customer to be able to provide to them whichever way they go.”

Pratt’s PW300 and PW500 derivatives will begin testing before the end of 2025.

Likewise, propulsion giant Rolls-Royce is also covering its bases, Executive Vice President of Business Development and Future Programs John Shade told Air & Space Forces Magazine. While Rolls has touted its AE engine family for CCAs, Shade said the company is also working on a new “Orpheus” line of less costly engines at its United Kingdom facilities, which it showed off at the conference.

“Where we see [drones] and CCA covering kind of a broad spectrum of solutions and power classes, we see our Orpheus product in that small-to-medium range, and then really the AE family in that medium-to-upper range,” Shade said.

The new wave of small engines leverage 3D-printing and digital design technologies to maximize performance and reduce costs—both key to the Air Force’s aim of fielding hundreds or thousands of uncrewed aircraft.

“If you go look at the CCAs that have been developed and flown, they’re using engines that were developed in the ’60s and ’70s,” said Gordie Follin, Chief Product Officer at small engine startup Beehive Industries. No one has publicly revealed what engines are powering CCAs developed by Anduril Industries and General Atomics, although Anduril’s YFQ-44A is reportedly powered by the William FJ44, an engine with origins dating back decades that powers the Cessna Citation, among others.

“There hasn’t been an introduction of modern technology to enable better performance,” Follin said. “The cost of those systems is still pretty high because they’re not produced in large numbers. And so I think really the main importance of propulsion is you need something that can be available at the scale and the cost that you want, and that doesn’t exist with those systems today, while still having performance that can be differentiating.”

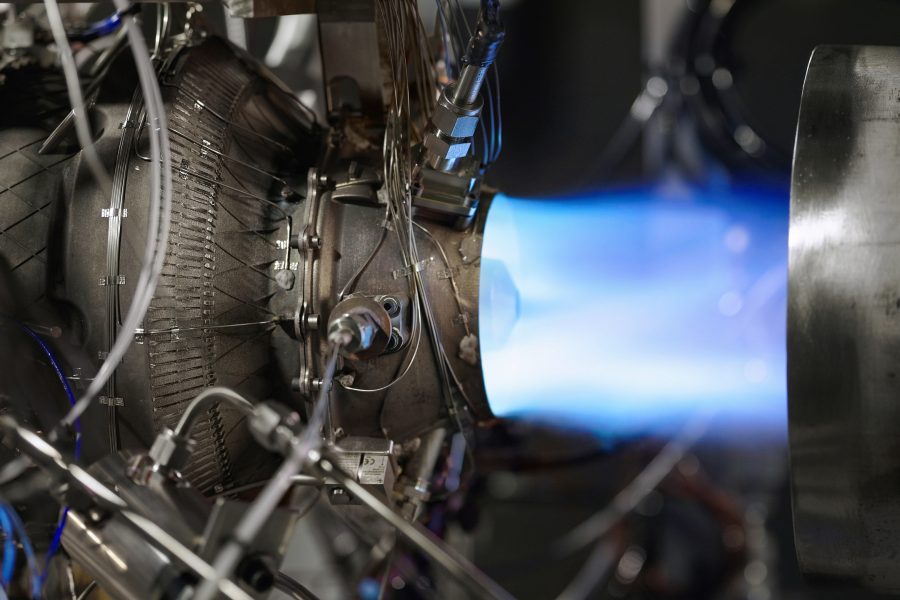

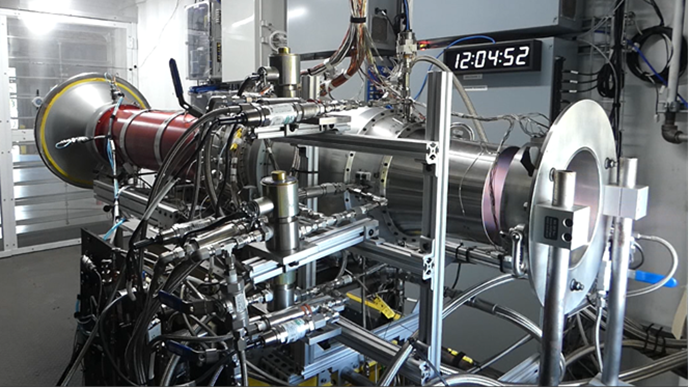

Beehive, founded in 2020, is leveraging additive manufacturing, also known as 3D printing, to reduce its parts count and produce engines at scalable volumes. Its Frenzy engine, designed to generate 100-300 pounds of thrust, is to begin flight tests and production in 2026, while its Peregrine engine, developed as a technology demonstrator for the Air Force, is rated at 500 pounds of thrust.

For Peregrine, Beehive took just 11 months to go from start to testing on a stand, Follin said. “So normally for an engine of that size and complexity, that would be like four to five years. So even at that size, I think, we’re able to 3-D print the long-lead, expensive, complex components that allow us to go fast and keep the cost down.”

Honeywell introduced its new HON1600 engine, rated for 800 to 1,600 pounds of thrust, at the conference. Like Beehive, it touted the importance of additive and digital twins in its development.

“We’ve designed this engine to meet the new generation of CCA and UAS platforms that require unprecedented performance to keep pace with mission demands,” Dave Marinick, president of engines and power systems said in a statement. “Our propulsion system is based on proven and tested technology in use today, plus the latest advancements in digital modeling and manufacturing, to enable a cost-effective and efficient solution for military operators.”

While the competition to power CCA, drones, and one-way missiles will be fierce, propulsion experts see growing need for small engines that can help bolster the Pentagon’s munitions stockpile.

“You have JASSM, LRASM, Tomahawk, those are existing systems, they’re the backbone of the standoff defense for the U.S., and they can’t get enough of them, right?” Follin said. “I saw somewhere it would take 13 years and like $400 billion to replenish the stockpile with those kinds of systems. So I think the reason there’s these other systems starting to be produced is because they realize, we can’t depend on this. We need something to supplement it, which is where you’re seeing the smaller applications come into play.”

Between drones and missiles, Follin predicted that “demand across all these platforms over the next 10 years is going to be huge.”

Editor-in-Chief Tobias Naegele and Editorial Director John Tirpak contributed to this report.