No single entity in the United States has been more severely affected by recent fuel price increases than the Air Force. USAF is the largest consumer of fuel in the federal government, but buys its supplies on the open world market and has little or no control over what it pays per gallon.

The Air Force spends almost $10 billion every year to fuel its airplanes and power its bases. Most of that money goes toward the purchase of jet propellant 8 (JP-8), the service’s petroleum-based kerosene standard.

| ||

|

A1C Timothy Schnitzer stows a refueling hose after refueling an F-15E at Seymour Johnson AFB, N.C. The Air Force has seen a 57 percent increase in fuel expenses from 2009 to 2011. (USAF photo by SSgt. Eric Harris) |

In Fiscal 2011, $8.3 billion of the Air Force’s $9.7 billion energy bill went to pay for fuel. The challenge service officials face almost every year is figuring out where to get the money to cover that expense when costs rise over the course of the fiscal year.

The Air Force, like the rest of DOD, is forced to project estimated costs almost two years in advance as part of its annual budget drill. Performing that sort of exercise is difficult enough for aircraft programs the Air Force directly controls, but it is much harder when trying to predict fuel prices set by a world market that is much too large for the service to influence.

Analysts at the Office of the Secretary of Defense provide the military services with a planning factor, essentially a placeholder figure for the estimated cost of fuel two years into the future. The gap between that planning factor and the actual cost of fuel often presents service officials with a funding headache.

This year, the Air Force is experiencing a $1.3 billion funding shortfall for fuel in Fiscal 2012 alone—a $1 billion gap that service officials attribute mainly to “blue” base budget operations, or Air Force-specific programs and partly to overseas contingency operations ($300 million).

The service originally estimated a $1.4 billion outstanding fuel bill but has since revised that figure downward. Still, the Air Force’s fuel situation is more serious than that of the Army or Navy—simply because the Air Force uses more fuel than its sister services.

Back in 2010, the Air Force projected that a gallon of fuel in 2012 would cost about $3.12, but the actual price is now around $3.85, said Maj. Gen. Edward L. Bolton Jr., the Air Force’s deputy assistant secretary for budget. Because the service buys 2.5 billion gallons or more per year, that gap becomes hugely significant and forces the Air Force to move money away from other priorities so that it can keep flying its airplanes, both domestically and overseas.

The funding shortfall is bigger this year than it has been in the past. It is larger because the gap between the projected and actual prices was abnormally large and because fuel prices jumped near the beginning of the fiscal year, increasing the time over which USAF had to offset its obsolete price estimate.

Still, the service is familiar with having to find money late in the year to pay for gas.

“Back in 2009 when we were planning for 2011, the planning factor was $2.37,” said Kevin T. Geiss, the Air Force’s deputy assistant secretary for energy. “We entered 2011 at $3.03, and we went up to $3.95. That shows you the huge disconnect, or potential disconnect, [associated with] the planning factor.”

More Desperate

DOD is sometimes fortunate and overbudgets for the price of fuel, “and that’s fun for that short period of time,” Geiss said. That last occurred in Fiscal 2009, when the Air Force had the luxury of using funding set aside for JP-8 to pay for other needs.

| ||

|

An F-22 refuels from a KC-135 tanker off the East Coast. Some 85 percent of the Air Force energy bill goes toward jet fuel. (USAF photo by MSgt. Jeremy Lock ) |

More commonly, though, the department’s predictive measures lag behind reality, and the impact of that lag has become much more serious in the last 10 to 12 years. During that span, the price of fuel has consistently grown both in absolute terms and relative to the early estimates.

“The difference between what was budgeted and what we’re paying [this year] is somewhere around $25, $26 a barrel,” Bolton said. That cost increase alone “is almost exactly what we were paying per barrel in 2000. Not only has it gone up by five or six times, but the increase this year was equal to what we were paying in one year,” he noted.

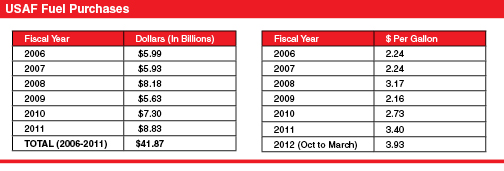

Statistics provided by the Defense Logistics Agency, the organization through which the Defense Department buys fuel, illustrate the trend.

In Fiscal 2009, the Air Force spent $5.6 billion for 2.61 billion gallons of fuel. In Fiscal 2011, the service bought almost the same amount of fuel but paid $8.8 billion for it. That’s a $3.2 billion increase, or 57 percent, in energy expenses over just two years.

The situation in Fiscal 2012 is even more desperate. Through the first half of this fiscal year, which spanned October 2011 to March 2012, the Air Force paid DLA $4.6 billion for 1.18 billion gallons of fuel. At that pace, the service would spend more than ever—but buy less fuel than it has used in any year since Fiscal 2006 (the earliest year for which DLA provided fuel purchasing records).

Once a funding gap is identified, the Air Force has several options it can employ to cover its fuel expenses each year. The service can slow down some operations and conserve fuel; it can move money from other areas into its fuel account, a process that requires approval from Congress; or it can use some combination of the two.

Each June, DOD submits an omnibus reprogramming request to Congress asking for permission to move money around and fund urgent needs or pay “year-of-execution” expenses, that is, bills that must be paid during the current year. The Air Force’s portion of the reprogramming often covers a wide range of programs and funding needs, but Bolton said that this year, the service will only ask Congress to let it shift money to pay its must-pay bills covering fuel and the war in Afghanistan, which sometimes overlap.

According to Bolton, whose financial management and budget office prepares the service’s draft reprogramming before it is evaluated by OSD, the service has to be careful—and a bit political—in determining what funding sources to ask for permission to raid.

This year, for instance, Bolton said he’s confident Congress will approve the Air Force’s recommendation to move money set aside for, but not spent on, incentivizing civilian and military employees to retire early. The service’s working capital fund also is likely to provide some available funding that can be used for fuel payments.

| ||

|

TSgt. Lequan Davis guides a fuel hose back to a truck after fueling a C-17 at McEntire JNGB, S.C. The Air Force will have to raid other budget areas to offset this year’s massive energy budget shortfall. (USAF photo by MSgt. Marvin Preston) |

After those funding streams, which Bolton called “easy takes,” have been exhausted, the service enters slightly more contentious territory. “The next level of controversy would be programs that have had recent restructures,” Bolton said. “For example, the [F-35 strike fighter] has had three restructures in the last five years. We did slow down the production rate, so when you go back and you look at [Fiscal 2012 funding], you may, hypothetically, happen to find some money there based upon restructures, fact-of-life changes, underexecution.”

The third level of the reprogramming, according to Bolton, includes the programs that the Air Force has recommended canceling or downsizing in Fiscal 2013, such as the Global Hawk Block 30 or C-130 Avionics Modernization Program. The service is free to ask Congress for permission to move money from those programs, but lawmakers also have instructed DOD not to take any irreversible actions that assume those recommendations will be approved. Stripping money from those programs while Congress is still evaluating the 2013 budget request might be construed by its members as too presumptive and lead them to reject the Air Force’s proposals.

Beyond those sources, the Air Force is left with few other options but to tap its operation and maintenance accounts, which fund flying hours, base operations, weapon systems sustainment programs, and many other daily activities that keep the service up and running.

“After we take the things we know we can take, and after we take the investment things that we feel we can take and negotiate, it’s going to come from O&M,” Bolton said.

Seeking Efficiencies

Cutting flying hours is an easy but largely unpopular way to save money, although the Air Force has sometimes chosen to fly less to cover outstanding fuel bills in the past. Geiss stressed, however, that if Army troops in theater call for supplies, an airlift out of danger, or an overhead strike from an F-15, those flights will happen no matter the cost of fuel. Given that need and the consistently high operational tempo in Afghanistan, it is little surprise that flying hours in Fiscal 2012 are on pace to nearly equal those in 2011.

A majority of those flights, Geiss said, come from the mobility fleet, which includes cargo aircraft and aerial refuelers. Those aircraft account for 900 flights a day and 60 percent of all Air Force fuel consumption on an annual basis.

The Air Force has experience in scrambling to pay fuel bills in the last several months of a fiscal year. At the same time, the service is working on a number of fronts to limit those unforeseen expenses in the future.

| ||

|

|

One avenue the Air Force is pursuing is investing in engine upgrades to some of its legacy aircraft, such as the KC-135 tanker and C-5 cargo hauler, in an effort to generate fuel savings and make sustainment cheaper over the long term. The Fiscal 2013 budget includes funding for KC-135 improvements that Geiss said should avoid $150 million in fuel expenses over the aircraft’s lifetime, but maybe more importantly, save $1 billion in general sustainment costs.

The service also has stressed the need to be more efficient with the way it flies its legacy platforms. Service officials often cite improving engine wash procedures, flying more direct routes, enhancing formation flying techniques, and optimizing how much cargo an aircraft takes on board before takeoff as small but important changes the Air Force is making to save fuel.

Third, the service is making a point to simply use less fuel, and its target is to decrease consumption by 10 percent (compared to 2006 levels) by 2015. Geiss said the Air Force has managed to trim its fuel usage by about four percent so far. If not for that progress, the service’s outstanding 2012 fuel bill could be even bigger.

“If we reduce our consumption in the Air Force, those are real dollars that the Air Force won’t have to steal from somewhere else [in the service], year after year,” he noted.

There’s also the potentially game-changing process of replacing JP-8 with domestically produced, non-petroleum-based fuel. Air Force officials say they are making progress certifying aircraft to operate on alternative fuels, but the service is not at the point yet of actually buying those fuels in bulk and putting them to operational use. Moreover, Air Force officials have said publicly that they hope to buy alternative fuels from market-based sources rather than investing in developing those fuels within the service.

Jeff Braun, chief of the Air Force’s Alternative Fuels Certification Division at Wright-Patterson AFB, Ohio, said that the service has certified every aircraft in the inventory to fly on a 50-50 blend of petroleum-based kerosene and synthetically produced fuel known as Fischer-Tropsch synthetic paraffinic kerosene. The SPK fuel is derived from coal, natural gas, or potentially a naturally occurring biomass.

According to Braun, the Fischer-Tropsch blend is available commercially at about the same price as JP-8 and in quantities that would allow the Air Force to cut back on petroleum purchases. This may not save the Air Force money in the short run, but it could help introduce some stability into the fuel budget planning because these synthetic fuels are not subject to the same price fluctuations as traditional jet fuel.

Creating a Single Standard

| ||

|

A C-17 on the first transcontinental flight fueled by a synthetic fuel blended with JP-8 passes over New York City in 2007. The Air Force plans to certify its aircraft on other synthetic fuel blends as soon as possible. (USAF photo by Randy Hepp) |

Braun said that if it wanted to, the Air Force could buy “hundreds of millions” of gallons of SPK fuel per year for the same cost as JP-8.

A problem Braun’s office is dealing with today is proving that its coal- and natural-gas-based SPK blends are no worse for the environment than JP-8, a standard the Air Force is required by law to meet before investing heavily in their procurement. Braun said measuring a fuel’s greenhouse gas footprint is difficult and somewhat subjective, making it hard to say definitively how the synthetic energy source compares to typical jet fuel.

“There are ongoing efforts [both within the Department of Energy and academia] to attempt to characterize the greenhouse gases footprint of both petroleum and the FT SPK,” Braun explained. “That is to say: How much [carbon dioxide] and other environmentally harmful products are produced through the cultivation, harvesting, mining, delivery, production, and combustion phases of utilizing these fuels? … Unfortunately, due to subjectivity, every study seems to produce a different characterization.”

The Departments of Defense, Agriculture, and Energy, and the Environmental Protection Agency, are working to build a single standard by which to characterize greenhouse gas emissions, he added.

Beyond the SPK blend, the Air Force has plans to certify its aircraft on at least two other types of alternative energy sources. A fuel known as hydrotreated renewable jet fuel should be certified for use by the end of this year, after a test on the F-22 Raptor’s F119 engine this summer. HRJ will eventually be certified for use by the entire Air Force inventory.

HRJ comes from plant oils and animal fats, and for that reason, the fuel is likely to meet the environmental requirements more easily than coal-based options, he said.

A third alternative, called alcohol-to-jet fuel, is planned for certification by the end of 2014. It, too, will be certified for use by all USAF aircraft.

None of those alternative fuels are likely to be operational by the beginning of Fiscal 2013 this fall, when the OSD planning factor for JP-8 is $3.73 per gallon. Only time will tell if that estimate again proves too optimistic, putting the Air Force in another stressful financial situation a year from now.

The Air Force is tired of this annual fuel cost scramble and hopes to gain financial stability and cost savings by decreasing its reliance on petroleum-based jet fuels. Had USAF been able to meet its 10-percent consumption-reduction target this year, “instead of a $1.4 billion shortfall right now, maybe we’d have half that,” Geiss said. “So it’s not a goal for the sake of having a goal. That’s real dollars.”