According to a spokesperson, USAF has never before presented acquisition information in this holistic way.

“Special access” programs and spending on bombers, bombs, and missiles headline the Air Force’s Fiscal 2019 acquisition portfolio by dollar amount, with space and agile combat support coming in a close third and fourth, respectively, according to an annual “how we’re doing” acquisition report released by the Air Force Wednesday. It said the service is reducing cost overruns on programs but continues to struggle with keeping them on schedule.

Service Secretary Heather Wilson, in a cover message, wrote, “Overall, the Air Force is improving on cost, schedule, and performance. However, we still have a lot of work to do.” The report explains how well USAF managed its programs in the past year, and provides a status report on the biggest ones.

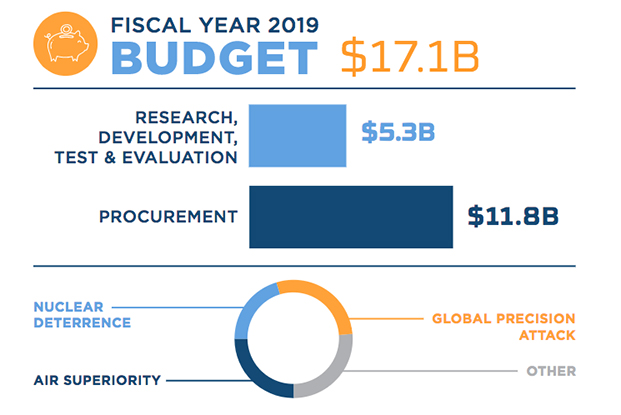

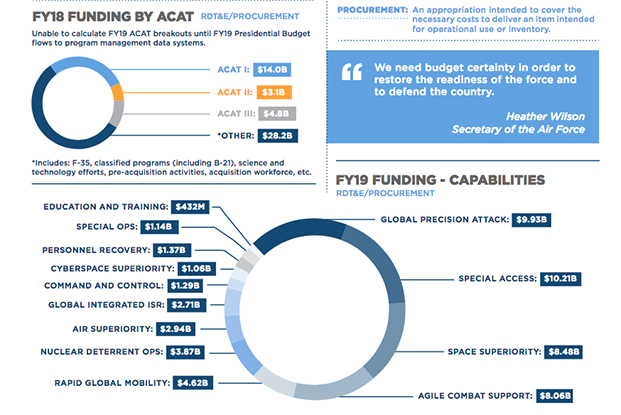

A service spokesman said this is the first time USAF has presented acquisition information in this holistic way, combining research, development, test, and evaluation with procurement in an annual amount and as projected over the Fiscal 2019-2023 future years defense plan, or FYDP.

For the fiscal year 2019 budget request, special access programs—those that are highly classified and compartmentalized—would receive the biggest share of dollars requested, at $10.21 billion. Global precision attack, which includes bombers, attack aircraft, and the munitions they release, is the second-biggest account, at $9.93 billion. Space superiority programs, including space situational awareness assets and development and purchase of new satellite constellations, is requested at $8.48 billion. Agile combat support, which is chiefly logistics, is pegged at $8.06 billion.

Rapid global mobility, which includes new KC-46 tankers, C-5M re-engining and refurbishment, and new C-130 tactical transports, is requested at $4.62 billion, as the fifth-biggest account. Nuclear deterrent ops, which covers development of new nuclear ballistic and cruise missiles and the upgrade of existing systems, ranked sixth in USAF requested acquisition funding, at $3.87 billion. Air superiority, which covers everything from new F-35s to upgrades of fourth-gen fighters and fifth-gen F-22s, as well as new air-to-air missiles, radars, and lasers, ranked seventh, at $2.94 billion. Rounding out the top 10, global integrated ISR would get $2.71 billion; command and control, $1.29 billion; and special operations, $1.14 billion.

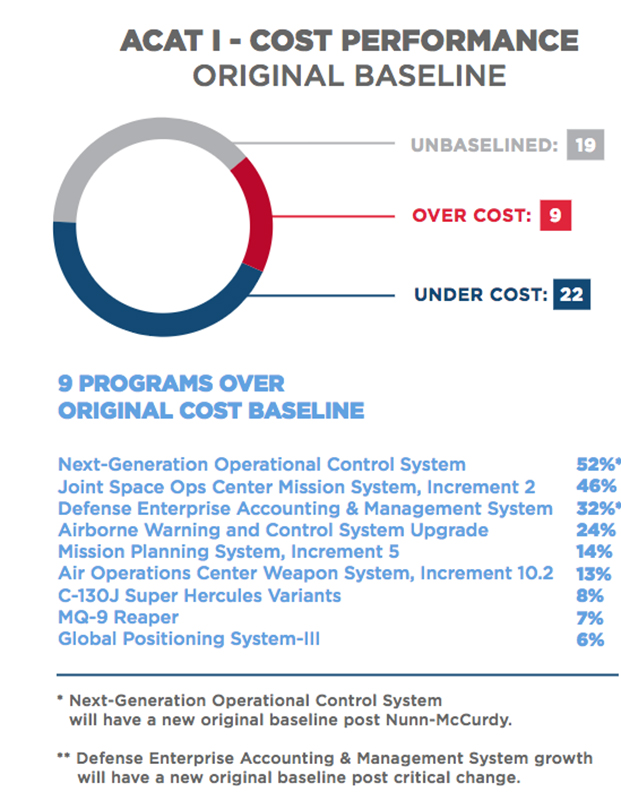

USAF has 50 “Acquisition Category 1,” or ACAT 1 programs; the biggest ones, worth up to $3 billion in procurement. Of those, nine are over budget while 22 are are under budget and 19 don’t have a baseline by which they can be measured over or under, according to the report. The biggest overages are on space projects, command and control projects, and aircraft. Though the report did not spell it out, some of the overages are simply because USAF is buying more units than it planned.

The worst offenders for being over cost are the Next-Generation Operational Control System, at 52 percent over, and the Joint Space Ops Center Mission System, Increment 2, at 46 percent over. Others mentioned include the Defense Enterprise Accounting and Management System effort, at 32 percent over cost, and an AWACS upgrade, 24 percent over.

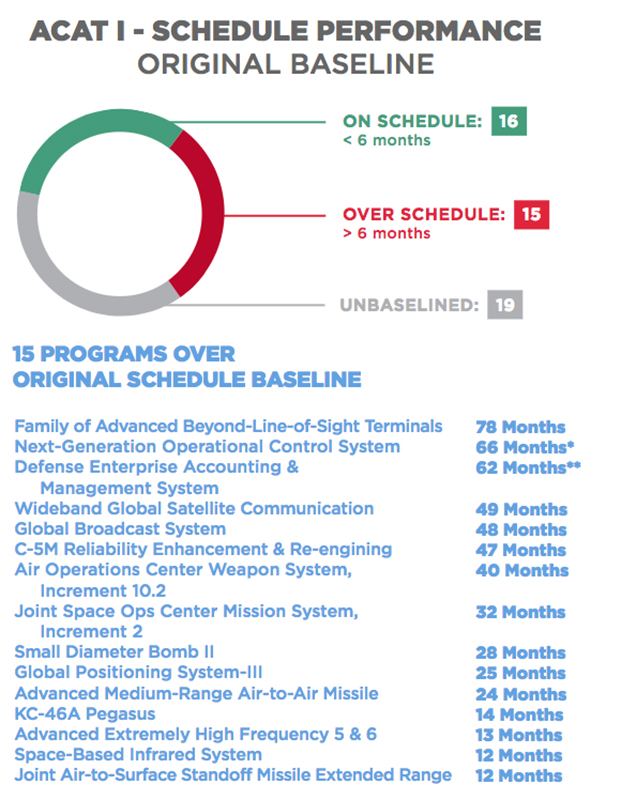

In schedule performance, about as many USAF programs are on time as late. The worst offenders here are the Family of Advanced Line-of-Sight Terminals, or FAB-T, more than six years late; the Next-Generation Operational Control System, more than five-and-a-half years late; the Defense Enterprise Accounting and Management System, five years late; and the Wideband Global Satellite Communication System, 49 months late.

Others in this category include the AOC Increment 10.2, now cancelled, but 40 months late when it was stopped, as well as the KC-46 tanker program, which the acquisition office pegged as 14 months late, and the AIM-120D AMRAAM dogfight missile, two years late.

In technical performance, 31 of the 50 ACAT 1 programs will meet key performance parameters, while 19 don’t have a baseline for cost or schedule.

Of 42 “ACAT 2” programs, which are worth less than $853 million, 18 are running under cost and 21 are on or ahead of schedule. The rest are either “unbaselined” or there aren’t any data yet with which to measure them.

A sampling of some major programs with their single- and five-year projected costs follows:

The acquisition office reported there’s $16.6 billion in funds planned for the B-21 Raider stealth bomber from 2019-2023, of which $2.3 billion is in the FY ‘19 request. The program is run by USAF’s Rapid Capabilities Office, headquartered at JB Anacostia-Bolling, in Washington, D.C.

The KC-46A tanker will command $16.9 billion of USAF’s budget over the FYDP, with just over $3 billion to be spent in FY ‘19. The unit cost is $217.9 million per aircraft, which USAF reported is 16 percent less than the originally planned unit cost. Delivery of Required Assets Available—the 18 aircraft needed to declare initial operational capability—slipped from August 2017 to October 2018. USAF plans to buy 179 KC-46s.

Space programs are to get $8.4 billion in Fiscal 2019 alone, with $5.9 billion for RDT&E and $2.6 billion in procurement. There’s one program in source selection—EELV launch vehicles—four in sustainment and 12 in development or production. Those in sustainment are mostly communications and navigation, while those in development are chiefly in remote sensing and next-generation navigation, positioning, and communications.

Two competing designs for the Ground-Based Strategic Deterrent are being undertaken with Boeing and Northrop Grumman. One design will be carried forward into development and production starting in late Fiscal 2020, and the first missile is to be delivered in 2029. The program is slated to spend $8 billion over the future years defense plan ending in 2023, and the missiles are being designed to serve until 2075.

The price of the MQ-9 Reaper remotely piloted aircraft has gone up seven percent due to capability upgrades, USAF said, quoting a figure of $33.7 million a copy. Over the FYDP, the Air Force plans to spend $5.2 billion on Reapers, of which $1.15 billion will be spent in FY ‘19 alone. USAF did not say how many aircraft it will buy over the FYDP, but it did note deployment of a new ground station in 2017 along with the Block 5 aircraft.

“Air Force One,” the colloquial name for the VC-25B Presidential Aircraft Recapitalization program, is budgeted for $673 million in FY ‘19 and $2.92 billion through the FYDP. In 2017, USAF “solidified” requirements, bought two pre-owned 747-8s on which to build the presidential transports, and launched preliminary design. An engineering and manufacturing development contract should be awarded to Boeing this summer.

The T-X trainer contractor is to be chosen in 2018, which will begin an ambitious effort to field the first units by 2024. USAF plans to spend $265.5 million on T-X in fiscal 2019 and $2.7 billion over the FYDP ending in 2023. The contract will be of the fixed-price-incentive firm type, which will include five test aircraft. The Air Force plans to buy 350 T-X aircraft.

USAF plans to spend about $10 billion on development and acquisition of the Long-Range Standoff cruise missile, or LRSO, of which it will spend $2.57 billion from Fiscal 2019 to Fiscal 2023. There’s $614.9 million in the FY’19 budget for LRSO development. The service plans to buy about 1,000 misiles for deployment and test, with the first ones becoming operational in 2030. Lockheed Martin and Raytheon have been working on design and risk-reduction contracts since August, 2017.

Upgrading the E-3 AWACS is slated to cost $2 billion over the FYDP, with $327.8 million to be spent in Fiscal 2019. The program was scaled back from 31 aircraft to 24, of which 17 Block 40/45s have been delivered. The remaining seven aircraft will be delivered through 2020. The unit cost of the upgrade is $117.3 million per jet—a 24 percent increase due mainly to reducing the fleet size.

USAF plans to spend nearly $1 billion buying C-130J transports from FY ‘19 through FY’23, and $2.1 billion on special operations variants over the same period. The vanilla C-130Js cost $110.8 million each; the HC/MC-130 variants cost $103.1 million apiece. The cargo J-models have seen an eight percent cost increase while the special mission variants have seen a 14 percent cost decrease. Plans to replace all C-130Hs with J-models have been dropped; the fleet will comprise 137 C-130Js and 163 C-130Hs.

The Air Force will fit 217 F-15Cs with the Eagle Passive/Active Warning and Survivability System (EPAWSS), which the report noted saw a cost increase from $10.2 million per jet to $11.5 million per jet “driven by a cut in units from 413 to 221.” Through 2023, the Air Force plans to spend $1.2 billion on EPAWSS. The critical design review took place six weeks ahead of schedule, USAF said.

The HH-60W Combat Rescue Helicopter is slated for $5.1 billion in spending over the FYDP, with $1.14 billion to be spent in fiscal ‘19. The Sikorsky unit of Lockheed Martin is building the first test aircraft, which is slated to fly in the fall. The first eight aircraft—four for training and four for operations—are to be delivered in 2020 and operational in 2021.

USAF plans to spend $26.3 billion on buying F-35As over the five years beginning in Fiscal 2019. The buy rate will stay at 48 per year until Fiscal 2021, when it increases to 54 per year. Full-rate production is slated to start in April of calendar year 2019.

The report said USAF continues to buy the AGM-158 JASSM-ER (extended range) and that it’s undertaking a wing replacement and software updates for previously delivered missiles. The service has stopped buying the baseline JASSM version and will buy 360 of the stealthy missiles in 2018. Through 2023, USAF will spend $2.45 billion on JASSM, which it said has a unit cost of $1.4 million per missile.

The acquisition report noted that USAF has asked Boeing to step up production of the JDAM bomb tailkit from 36,500 to 45,000 units per year. USAF has previously said it is moving to replace stockpiles that were heavily drawn down during that anti-ISIS campaign in Iraq and Syria. USAF plans to spend $2.19 billion on JDAMs through 2023, and the unit cost is $28,000 per tailkit, down 35 percent from the original cost of $43,000 per unit.

Small Diameter Bomb II development and production is slated for $1.45 billion in the FYDP, with $174 million in fiscal ‘19. Completion of a 28-shot series of tests will conclude development. There have been delays in software and “flight test anomalies” are being investigated.

The B61-12 tail kit assembly, for use with the B61 nuclear bomb, is entering the production phase in 2018, according to the report, which noted that it’s going to be integrated on the B-2 and B-21 bombers, F-15E and F-16 fighters, F-35, and German Tornado aircraft.