The world’s largest defense contractor says it’s given up on trying to buy the only U.S. maker of certain propulsion components of missiles and missile defense kill vehicles.

The Federal Trade Commission announced in January that it was suing Lockheed Martin to block the company from acquiring Aerojet Rocketdyne. On Feb. 13, Lockheed Martin announced in a press release that it had terminated the purchase agreement.

“Our planned acquisition of Aerojet Rocketdyne would have benefitted the entire industry through greater efficiency, speed, and significant cost reductions for the U.S. government,” said Lockheed Martin chairman, president, and CEO James Taiclet in the release. “However, we determined that in light of the FTC’s actions, terminating the transaction is in the best interest of our stakeholders.”

Suing to block a defense merger for the first time “in decades,” the FTC argued that if the deal went through, Lockheed Martin could “use its control of Aerojet to harm rival defense contractors and further consolidate multiple markets crucial to national security and defense,” according to a statement published Jan. 25.

“If consummated, this deal would give Lockheed the ability to cut off other defense contractors from the critical components they need to build competing missiles,” Bureau of Competition Director Holly Vedova said in the statement.

In Lockheed Martin’s quarterly earnings call Jan. 25, Taiclet said the company would consider options for the $4.4 billion it had set aside for the purchase, such as research, capital improvements, and other mergers and ventures.

“Moving forward, we will maintain our focus on the most effective use of capital with the highest return on investment, including our ongoing commitment to return value to shareholders,” Taiclet said in the Feb. 13 release.

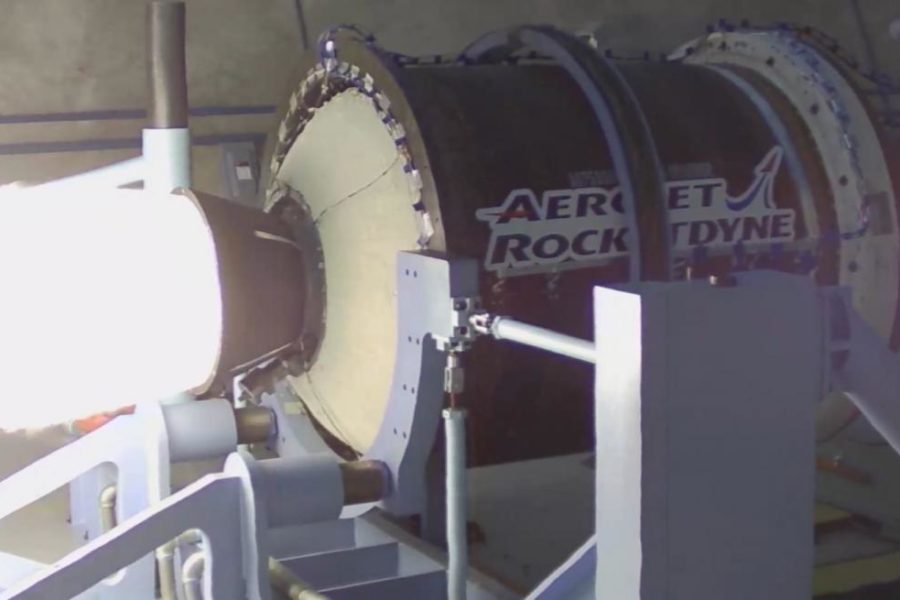

In a statement released Feb. 13, Aerojet Rocketdyne looked to reassure its own shareholders, touting its role in “advancing hypersonics and strategic, tactical, and missile defense systems.”

“We are confident in our future performance with an impressive backlog that is more than three times the size of our annual sales and a strong macroeconomic environment underpinning our portfolio,” according to the company statement. “We look forward to providing further details regarding our financial performance and strategy on our fourth quarter and full year 2021 earnings report on Feb. 17, 2022.”