National Security Space must start to use commercial satellite architectures.

We are moving to a new era in space, from a time when the United States was the clear dominant power to an era of competition. During this era of U.S. space dominance, space was basically a safe haven. Today, however, space is a truly international domain, used by up to 60 countries and a robust and growing commercial industry. The United States now has near- peer competitors in China and Russia and evolving competitors in India, North Korea, and Iran. As a result, space has become more congested and dangerous with a diversity of real and emerging threats.

Our National Space Strategy, released in March 2018, makes this clear: “While the United States would prefer that the space domain remain free of conflict, we will prepare to meet and overcome any challenges that arise.” The new reality is that growing congestion could cause the unintentional loss of systems through collisions, and a determined adversary can threaten or eliminate our Space Systems. As the June 2020 Defense Space Strategy states, “China and Russia each have weaponized space as a means to reduce U.S. and allied military effectiveness and challenge our freedom of operation in space.”

It now makes increasing sense for the Department of Defense to take advantage of commercial space to drive innovation, reduce risk, improve schedules, and manage costs.

Meanwhile, commercial space has transitioned from following to leading innovation in communications, launch, and high-volume production buses, it now makes increasing sense for the Department of Defense to take advantage of this market to drive innovation, reduce risk, improve schedules, and manage costs in National Security Space (NSS).

The National Defense Authorization Act of 2018 directs DOD to leverage commercial space to provide affordable resiliency for space-based operational sensors. While at the senior leadership level there is agreement on this, comfort with existing processes and approaches drives traditionalists to make demands that commercial providers cannot rationally meet, including security classification of the development process, expensive and time consuming oversight, nuclear hardening requirements, and more. We need to find a way to reward the use of commercial space and not penalize it. The fact is, a determined adversary can eliminate nodes or systems whether they are NSS or commercial.

While the Defense Department takes advantage of commercial launch and is becoming more comfortable and adept at buying the service—not the rocket—there are still many DOD special requirements for buying a commercial service. As a result, the department pays 30 percent or more than anyone else for a Falcon-9. The Defense Department asks for more “special services” because the payload is often a multibillion-dollar vehicle that, if lost, can’t be replaced for another decade. As we move to a resilient proliferated future, where the cost of space systems drops to the hundreds of millions or less and delays are more manageable if losses occur, we can rethink launch-reliability requirements, as well as necessary oversight. We also can investigate and update the way we buy other commercial space capabilities, such as satellite buses and communications.

Resiliency by Leveraging Commercial Space

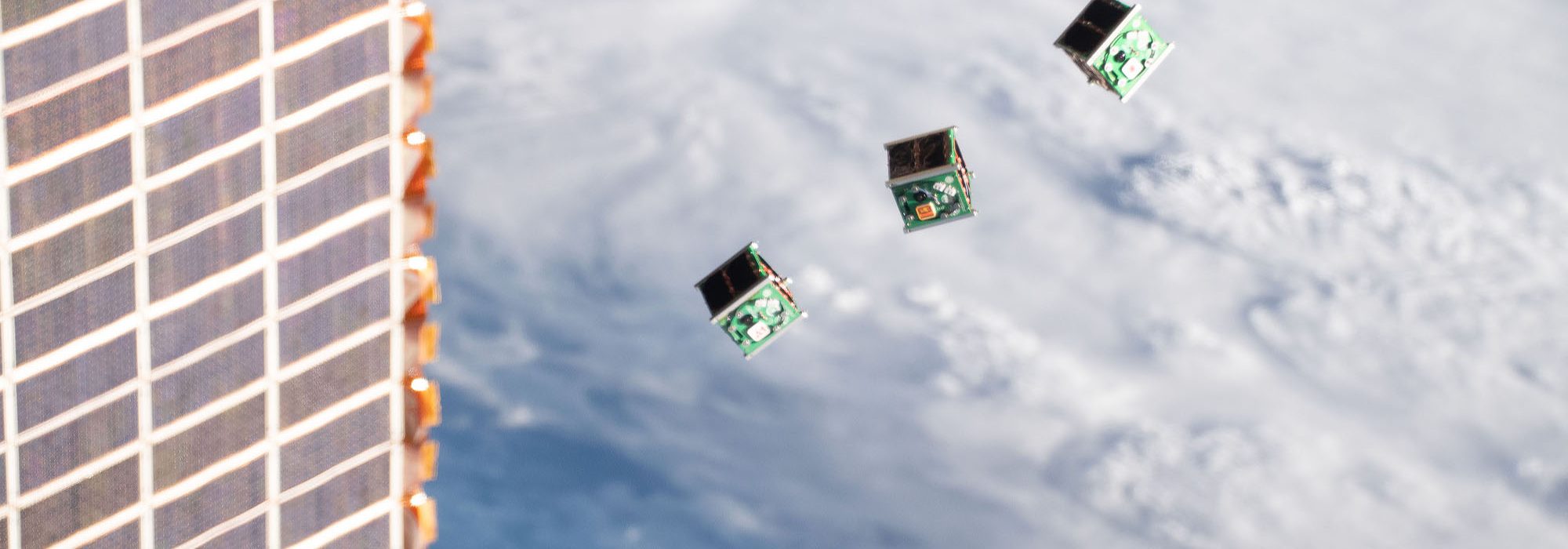

To ensure mission capability, the U.S. National Space Strategy calls for moving to resilient constellations that not only survive the loss of individual nodes, but continue operating without affecting the mission. Gen. John E. Hyten, Vice Chairman of the Joint Chiefs of Staff, called this essential in 2019: “We should move away from procuring a handful of ‘exquisite’ costly satellites that make for ‘large, big, fat, juicy’ targets. Instead of ‘fragile and undefendable,’ I am in favor of more resilient, more distributed capabilities, such as cheaper, small satellites. A constellation of such small satellites is likely to enable both greater dispersion of our space assets and the ability to rapidly recover in the event of an attack.”

To take full advantage of commercial space capabilities we must significantly increase our use of commercial buses and their ongoing production lines; commercial launch services; and commercial communications.

The National Space Strategy states: “Strategic partnerships with commercial firms will continue to enable access to a more diverse, robust, and distributed set of space systems and provide easily releasable data.” It goes on to say that the United States will pursue such partnerships “in areas that both stabilize costs and improve the resilience of space architectures.”

Resiliency will require much larger production quantities, driving the need for affordable cost and responsive schedules. Future buses must accommodate a variety of payloads and orbits without being redesigned, providing more flexibility to the Space Force and other customers. Responsibility for integration, and compatibility will fall to the payload—a radical change from today, where the bus, rather than the payload, must adapt.

DARPA’s Blackjack, Space and Missile Command’s (SMC’s) CASINO, and other proliferated low-Earth orbit (pLEO) systems follow this model. Additionally, SpaceX, Amazon, Telesat, and Samsung are among those moving in this direction. After OneWeb went into bankruptcy, the British government and Bharti Global purchased its assets in July 2020 and now plan a $1 billion investment to revive the company. Thus, a growing variety of commercial bus options complement the many commercial GEO buses that are already very mature. Commercial buses are even moving into MEO, such as SES/Boeing partnering on the O3b bus.

This means DOD can purchase buses off existing production lines. If the mission payload is the central focus, the payload contractors can be required to assure compatibility with a commercial bus or buses, even as bus production lines evolve to meet market demands. SMC has taken an aggressive posture on implementing a commercial bus approach by beginning development of modular bus/payload interface standards, such as the Payload Users Guide describing the standard interface for SMC’s Long-Duration Propulsive ESPA (EELV Secondary Payload Adapter) program, using Northrop Grumman’s standard ESPA Star bus, which can be downloaded from the Internet by any prospective payload developer.

Defense Department customers will ask: “How will we get the systems engineering, quality, and mission assurance/reliability standards, etc., that we had in the past?” DOD customers can learn from commercial satellite customers, who—while very schedule- and budget-driven—also demand full satellite capability—usually for 15 years or more on orbit. If the Space Force presents commercial bus providers with sufficient, sustainable demand, they will respond; if not, they won’t.

Another cultural barrier is trust: Will the satellite be there when needed? The fact is, it’s not clear today that current Space Force systems will all be there in a peer fight. With commercial-based systems, however, the loss of a payload will likely be less, given that the difference in cost would enable the Space Force to have more vehicles on-orbit, making the overall system more resilient to attack.

Other barriers to using commercial communications satellites and commercial buses are the requirements for Class A development, intrusive data rights, and nuclear hardening. Our adversaries have demonstrated that our individual satellites are vulnerable to laser blinding, jamming, spoofing, kidnapper satellites, cyber tampering, and kinetic anti-satellite weapon threats. Given the numerous nonnuclear means of interfering with or destroying satellites, it’s clear a determined adversary can attack individual satellites/nodes—possibly with plausible deniability. Meanwhile, there appears to be little or no evidence that our adversaries are considering nuclear detonation as a preferred course of action to destroy or disrupt U.S. satellites. Therefore, perhaps nuclear hardening should no longer be a driving requirement for future DOD architectures.

While it may not be likely that Russia or China would attack commercial communications, the risk to those systems would rise if military capability were on-board. The key to a successful space posture is for the mission of the satellite constellations to endure despite the loss of individual nodes, and therefore make it far less useful to attack individual commercial nodes. As more communications satellites move to LEO, there is increased risk that a rogue nation such as Iran or North Korea could initiate an attack, given that it is far easier to attack in LEO than in GEO/HEO or MEO.

The current practice of requiring all satellites to survive prompt dose and HEMP (high-altitude electromagnetic pulse) hardening drives costs up and slows down schedules, limiting the number of satellites DOD can buy. This impedes our space security objectives and drives us to create large and expensive space targets that are vulnerable to other destructive and disruptive capabilities. We are enabling rather than deterring our adversaries from using anti-satellite capabilities.

Meanwhile, an increasingly mature and innovative commercial space marketplace is hardening its systems against total radiation doses from the natural radiation environment, sufficient to handle all but the worst prompt dose and HEMP effects. Existing “Class A” and “long life” requirements mean more expensive parts, more processes, and more paperwork produced by more engineers. That costs money.

Leveraging Commercial Launch

In a recent study by Rand regarding the launch market, “Assessing the Impact of U.S. Air Force National Security Space Launch Acquisition Decisions” (Rand Document Number: RR-4251-AF-2020), the authors classified launch into three categories: government, commercial, and commercial-like. The found that “the launch reliabilities under all three types cannot be considered statistically different with 95 percent confidence.”

The commercial launch industry today is driving down cost and seems to have cracked the last real barrier to launch reliability. At a time when NSS is moving to more light/medium lift and a higher-risk tolerance, the commercial launch industry is dramatically improving reliability in the market segment most needed by the NSS community.

The current SMC Launch Service Provider (LSP) acquisition seeks to certify at least two commercial providers for DOD launches and offer them a certain number of missions. Future acquisitions could offer the ability to certify and “on-ramp” additional commercial launch service providers as DOD needs and market forces permit. The team and processes created by SMC to certify the LSP missions should be maintained, and refined, to enable future competitors to enter the DOD marketplace. Allowing any and all launch companies that want to be in the NSS stable to become certified would enable every launch to be competitive.

The United States should move away from having launch contractors bid for a number of launches and instead select the best solution for each particular launch. While there will continue to be an ongoing need to have a stable of qualified contractors, we need to also include the option for programs to select competitive commercial launch options that meet program requirements. Recently, SMC commercially acquired two R&D launches from VOX Space. A strong first step in this direction. The key to future success will be for DOD to clearly define and adopt rapid reconstitution requirements

In an era of reusable boosters, NSS should not care about reusability, but focus instead on capability, reliability, cost, and schedule. If reusability gives a contractor a cost, schedule, or reliability advantage, fine: That is the contractor’s approach and the contractor’s call—each solution competes on its own merits.

Commercial satellites can rapidly switch launch vehicle providers to allow them to get a better price and meet schedule demands if a specific vehicle is delayed. Defense Department missions should adopt this same approach.

Rapid reconstitution is the ability to get replacement space capability assets on-orbit to replace on-orbit losses, building back up the constellation resilience as losses occur. Obviously ground spares and rapid launch are the keys to this. Much like resilience, the ability to achieve “rapid reconstitution” is predicated on assured availability on a very short timeline. It means a provider with boosters in a development flow that can be pulled; flexible boosters that can be rapidly repurposed, or numerous qualified providers positioned to respond rapidly.

Space-Based Communications

The U.S. National Space Strategy says, “DOD will leverage and bolster a thriving domestic civil and commercial space industry.” In the case of communications, DOD is already heavily invested in commercial ground and user equipment. This is a stated goal of Space Force’s Vision 2030. The path to get there will require robust dialog between DOD acquirers, warfighters, and commercial providers.

Michael D. Griffin, former undersecretary for research and engineering, prior to departing the Pentagon earlier this year, likened the requirement to replacing the venerable High Mobility Multipurpose Wheeled Vehicle (HMMWV). “We’d be lost if we tried to get a traditional defense prime to design, manufacture, and sustain a HMMWV for us, but we’d be equally lost if we had just bought a commercial SUV off the line and fitted it with DOD stuff in an ‘aftermarket’ mode. Neither would address our need, which was in a few words ‘commercial-style production of a DOD design.’ We employ commercial automakers to build it. Much of the design is in fact ‘commercial.’ I mean, we aren’t custom-building the engines, the alternators, the steering mechanisms, etc., etc., but the overall design is a design to meet DOD requirements. It is not a commercial design, (though there are commercial adaptations, but, bottom line, we are using commercial contractors, methods, assembly lines, and business practices to build a design to DOD requirements. That is the pattern that I think will prove most fruitful for us in the majority of cases going forward.”

Commercial COMSATS boast radiation and cyber robustness that is the equal, or sometimes even better than military-dedicated capabilities. Commercial COMSAT businesses can also turn technology faster than DOD, and DOD wants to take advantage of their diverse frequencies, waveforms, and form factors.

The U.S. government must establish trusted commercial partnerships to ensure industry can provide the right capabilities when and where they are needed. This needs to be a true partnership where COMSATCOM is treated as vital infrastructure. COMSATS are clearly “fat, juicy targets,” especially the secure and protected systems; wideband nonsecure and nonprotected systems may be less attractive, but not out of the question; attacking commercial COMSATs would represent a major escalation, but it is feasible that Russia and China could attack these, too.

With the threat environment and landscape becoming more contested, congested, degraded, and operationally limited, warfighters must also have the option to roam between military and commercial satellites to achieve mission assurance. We must refresh and upgrade SATCOM capabilities to ensure roaming across multiple bands, orbits, and networks. The utilization and integration of commercial SATCOM capabilities with existing military SATCOM empowers DOD to rapidly access a diverse, disaggregated, and resilient communications network, complicating the enemy’s targeting calculus.

Technological advances within the commercial sector are enabling security measures to mitigate cyber threats, reducing potential vulnerabilities, and limiting the impact on national security interests. For example, high-frequency reuse strategies, like targeted spot beams, are inherently more jam resistant. Commercial SATCOM partners have been able to leverage and incorporate U.S. government requirements by design, enabling inherently more resilient platforms. This effort has led to commercial capabilities having “DOD-grade” security built in.

Finally, with resilience defined as our major defense against attack, how better to achieve that than to purchase capability from multiple large constellations? Doing so promotes competition and the inherent price and technology advantages that brings, while also assuring options should any single system fail. Commercial companies are now developing new capabilities much faster and more affordably than the U.S. government can.

We need to grow into this new view of space operations over time, starting with a mix of commercial and DOD purpose-built systems and moving, as commercial systems become more robust than purpose-built systems, to an all-commercial model. This can increase both agility and versatility by selective use of different types of constellations and a variety of altitudes to react to what is needed at any given moment.

Mission-Focused Procurement

The Department of Defense is already making changes to how it acquires space systems, and leaders have openly expressed a goal to better leverage commercial space. The new Space Force, through SMC and RCO (Rapid Capabilities Office), SDA (Space Development Agency), and the assistant secretary for space acquisition has made strides, but more must be done.

We should move immediately:

- Make mission/payload contractors the prime contractor, responsible for purchasing a commodity bus that supports their mission.

- Purchase commercial buses from a range of suppliers to increase innovation and drive prices down.

- Move toward purchasing launch services on the open market, just like commercial space does, and invest in boosters before they are needed in order to be able to call on them when needed for rapid reconstitution.

- Accelerate the purchase of commercial communications capability and integrate commercial satellite services as part of a resilient DOD network.

- Invest in the technology to be able to roam between dissimilar communications architectures to further increase resilience.

Tom “Tav” Taverney is a retired Air Force major general and a former vice commander of Air Force Space Command.